When it comes to financing —whether it’s starting a business, funding your education, or launching a new project—understanding your options is very important.

Two common options are grants and loans. But what’s the difference between these two?

Let’s break it down!

Understanding Grants

What is a Grant?

Grants are funds provided by governments, organizations, or foundations that you don’t have to pay back.

They’re often aimed at supporting specific projects or initiatives, like education, community development, or research.

Advantages of Grants

- No Repayment Required: Grants provide funds that do not need to be repaid, allowing for risk-free financial support.

- Access to Additional Resources: Many grant programs offer mentorship, training, or networking opportunities alongside financial support.

- Local initiatives: For example, the Lagos State Government has allocated approximately ₦25 billion (about $32 million) in grants and loans to Small and Medium Enterprises (SMEs) through the Lagos State Employment Trust Fund (LSETF) over the past six years.

This initiative aims to empower entrepreneurs and stimulate economic activity within the state.

Disadvantages of Grants

Landing a grant isn’t a walk in the park.

Here are some disadvantages of getting grants:

- Competitive Application Process: Securing a grant can be highly competitive, requiring extensive documentation and proposals.

- Specific Eligibility Criteria: Grants often come with strict eligibility requirements that may limit access.

- Restrictions on Fund Usage: Recipients must adhere to specific guidelines regarding how the funds can be utilized, which can constrain flexibility.

Understanding Loans

What is a Loan?

Loans, on the other hand, are borrowed money that you’ll need to repay—usually with interest.

These can range from personal loans to business loans, each designed to help you achieve different financial goals.

Advantages of Loans

- Access to Larger Sums of Money: Loans can provide significant funding amounts that may exceed typical grant offerings.

- Flexibility in Fund Utilization: Borrowers have greater freedom to allocate loan funds according to their business needs.

- Single-Digit Interest Rates: Initiatives like those from the Lagos State Employment Trust Fund (LSETF) offer loans with low interest rates, enhancing affordability and manageability.

Disadvantages of Loans

- Repayment Obligations: Borrowers must repay the principal amount plus interest, which can lead to financial strain if not managed properly.

- Potential for Debt: Mismanagement of loans can lead to significant debt, jeopardizing financial stability.

- Collateral Requirements: Some loans may require collateral, posing risks to personal or business assets.

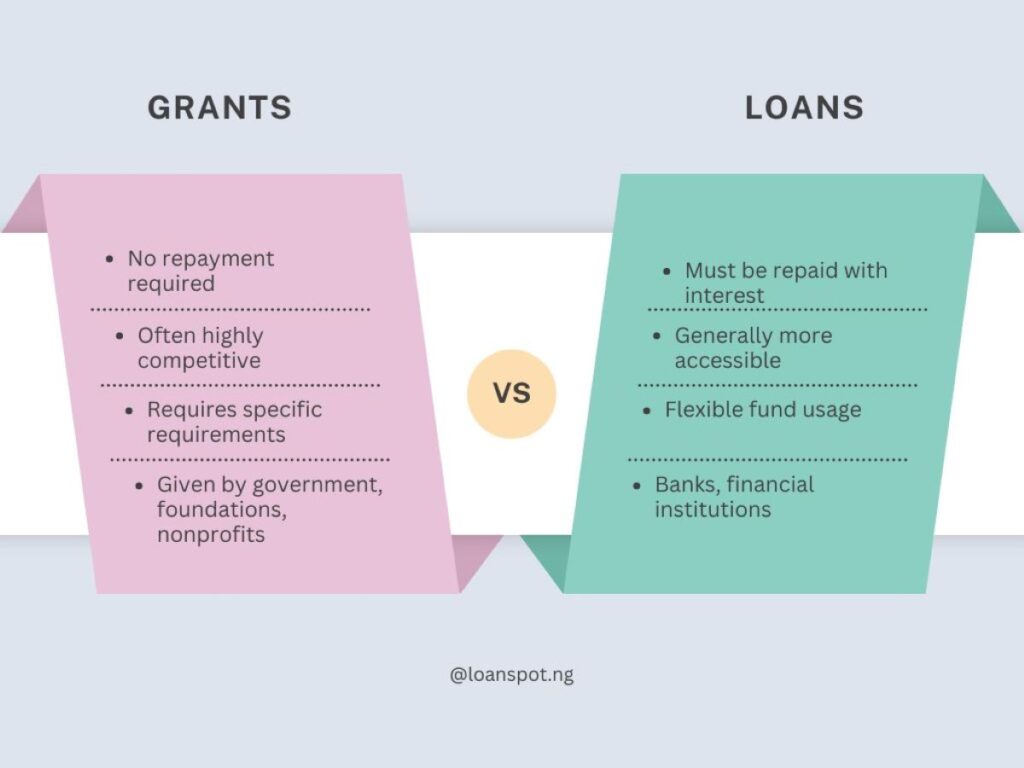

Key Differences Between Grants and Loans

The main difference between grants and loans is that grants are financial gifts that don’t require repayment, while loans are borrowed funds that must be repaid with interest.

Grants are typically awarded by governments, organizations, or foundations for specific purposes and come with eligibility criteria and usage restrictions. Loans, on the other hand, are provided by financial institutions and offer more flexibility in fund use, though they require a repayment plan, often with interest.

Choosing between a grant and a loan depends on factors like eligibility, funding needs, and repayment capability.

Here’s a quick comparison table that sums it up.

| Feature | Grants | Loans |

| Repayment | No repayment required | Must be repaid with interest |

| Application Process | Often highly competitive | Generally more accessible |

| Fund Usage Restrictions | Yes, usually specific requirements | Flexible fund usage |

| Typical Source | Government, foundations, nonprofits | Banks, financial institutions |

Types of Loans Available

If you’re leaning toward a loan, here’s a quick rundown of some popular types in Nigeria:

- Bank Loans: Traditional and reliable, these loans often offer competitive interest rates but may require a solid credit score.

- Government Small Business Loans: These are backed by the government and often come with favorable terms for small businesses, making them a great option for startups.

- Alternative Lender Loans: If traditional banks aren’t your style, online lenders can provide quicker funding with less stringent requirements. Just keep an eye on interest rates!

Types of Grants Available

Thinking about applying for a grant instead? Here are a few to consider:

- Federal and Provincial Grants: These are often designed for specific industries or purposes, like research or technology.

- Private-Sector Funding: Many corporations offer grants to support community initiatives, innovation, or local businesses.

- Nonprofit Funding Sources: If you’re running a nonprofit, there are plenty of grants out there to help you serve your community better.

In Nigeria, initiatives like the Enhancing Financial Innovation & Access (EFInA) have successfully included over 4.68 million Nigerians in financial systems through various grants.

This includes significant contributions towards women’s financial inclusion, with about 2 million women benefiting from these initiatives.

These examples show how grants can create a positive ripple effect in communities.

How to Choose Between a Grant and a Loan

Deciding between a grant and a loan can be a lot.

Here’s a step-by-step guide to help you make the right choice:

- Assess Your Funding Needs

Determine the amount of funding you need. Grants may not cover large-scale projects, whereas loans can provide more substantial sums. Decide if a smaller, risk-free grant will be sufficient or if you need the flexibility of a larger loan. - Consider Your Timeline

When do you need the funds? Grants often have longer processing times due to competitive application and approval processes, while loans can typically be secured more quickly. If you need funds immediately, a loan may be a better option. - Evaluate Your Eligibility

Look closely at the eligibility requirements for both grants and loans in Nigeria:

- Business Registration: Many grants, especially those from the government or international bodies, require that your business be registered with the Corporate Affairs Commission (CAC).

- Industry-Specific Criteria: Some grants are only available to certain industries, like agriculture or tech. For example, the Nigerian Youth Investment Fund (NYIF) focuses on youth-led businesses in particular sectors.

- Location and Size of Business: Some funding programs, like those from the Lagos State Employment Trust Fund (LSETF), target businesses operating within Lagos State, primarily small and medium enterprises.

- Credit History and Financial Documentation: For loans, especially those from banks, your credit history and financial records will likely be reviewed. Certain grants may target financially underserved groups but may still require some documentation.

Conclusion

You see, understanding grants and loans doesn’t have to be intimidating.

What you need to know are the differences, advantages, and disadvantages of each option, which helps you make a more informed decision that aligns with your goals.

Whether you choose a grant or a loan, take your time, do your research, and don’t hesitate to seek advice if you need it.

All the best!