Traditional loan applications got you feeling stuck in a never-ending loop of paperwork?

You’re not alone. For many Nigerians, getting a loan through those channels feels like climbing Mount Everest in slippers.

But wait! There’s a game-changer: loan apps!

These apps have gained popularity rapidly because they bypass the conventional barriers to borrowing.

One of the biggest perks? Many loan apps offer quick and easy access to credit, often without the need for a credit check.

With all these being said, here are the top 10 loan apps without credit checks in Nigeria.

Top 10 Loan Apps in Nigeria (without Credit Checks)

1. Okash

Okash is one of the most well-known loan apps in Nigeria. It is part of the Opay group and gives out loans right away of up to ₦1M.

Okash Interest rates are pretty high, running from 10% to 30% per month. This is because the app is flexible and gives money out quickly.

Okash not only lets you get quick credit, but it also works with other financial services like bill payments, money transfers, and online shopping, giving its users a complete financial tool.

The large number of downloads and good reviews of the app in the Google Play Store show its strong user base.

For more on Okash loan, check out my guide on how to borrow money from Okash

2. Alat by Wema

Alat by Wema is not just a loan app; it is also a full-fledged digital bank that has been approved by the Central Bank of Nigeria.

It gives out different kinds of loans, like personal and salary-based loans, with a loan amount of up to ₦5 million.

In Nigeria, this makes it one of the digital lenders with the most loan amounts that can be given.

The application process is easy and all digital, which makes it appealing to people who want quick and easy banking options.

Alat is a popular choice for many Nigerians who want to manage their money well because it offers both banking and lending services on a single site.

Want to know more about Alat? Well, check out my review of Alat by Wema

3. PalmCredit

PalmCredit is a quick loan app that gives its users short-term loans.

Their loans range from ₦2,000 to ₦100,000, and the interest rates are between 14% and 24%. The app is known for how quickly it processes requests; loan decisions are often done in minutes.

PalmCredit is appealing to people who need cash quickly and for a short time. It is easy to use and is especially good for people who don’t have access to regular banking services.

Regularly paying back PalmCredit loans can also help you improve your credit scores, which can be helpful for future financial transactions.

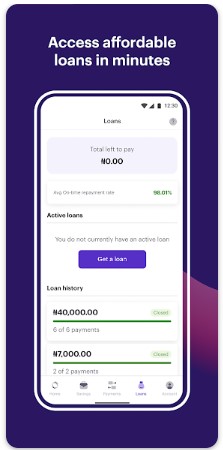

4. Carbon (Paylater)

The Carbon loan app has a flexible tool that can be used as both a digital bank and a way to get quick loans.

Carbon Loan amounts can be very large, up to ₦1 million, and they are given out very quickly, often just minutes after being approved.

Their interest rates change based on the loan amount and length of time, but they are low compared to other online lenders.

Carbon’s app is easy to use and lets you easily manage your loans. It also has tools like investments and savings, making it a complete financial app and users can pay back their loans in many different ways, depending on their current financial position.

To apply for a Carbon loan, check out my guide!

5. FairMoney

FairMoney offers loans of all amounts, up to ₦500,000, and is known for its fast service; loans are usually sent out within minutes.

Interest rates are flexible and can be anywhere from 10% to 30% per month, based on the size of the loan and how long it takes to pay it back. This app stands out because it is easy to use and gets things done quickly.

If you need money quickly and don’t want the hassle of applying for a standard loan, then you will like this app. FairMoney also lets borrowers extend the time they have to pay back loans by up to 12 months, this gives them plenty of time to handle their money.

6. Branch

The Branch loan app offers loans of up to ₦200,000 and is known for being quick and reliable. The app has a simple application process that doesn’t require any paperwork or security.

Interest rates can be anywhere from 14% to 28%, and loan terms can be anywhere from one month to about a year.

This gives borrowers a lot of options. The Branch mobile app is easy to use and makes it possible to get a loan quickly—often within 24 hours. This makes it very useful for people who need money quickly.

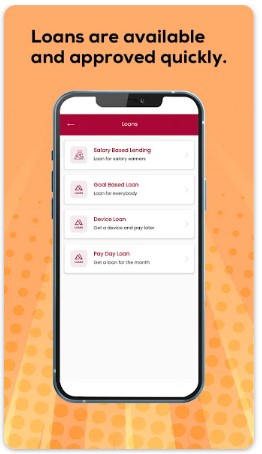

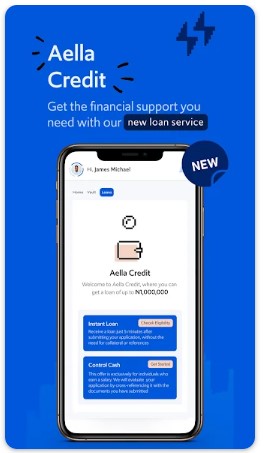

7. Aella Credit

Aella Credit is mostly aimed at employees with steady incomes, but it also helps people in other situations.

It offers loans between ₦1,500 and ₦1,000,000, so it can be used for a lot of different types of borrowing. Depending on the borrower’s risk level and the length of the loan, interest rates range from 4% to 29% per month.

The credit scoring method at Aella Credit is unique because it looks at a lot of different factors when deciding who to lend money to. This means that they can tailor their services to meet the needs of each person.

For more information on Aella Credit, check out my guide.

8. Migo

Migo takes a different method by letting you access loan services through your bank account or a USSD code, so you don’t even need a smartphone app. On the Migo loan app, you can borrow as little as ₦500 and as much as ₦500,000.

Also, the interest rates are changeable; they are usually around 10%, but they can change based on how long the customer has used the service.

Migo offers flexible payment terms, and the site makes it easy to pay by bank transfer or right from the app.

You should check out my guide on how to apply for a Migo loan.

9. QuickCheck

QuickCheck claims a quick and easy loan application process that won’t cause you any trouble. It’s possible to get loans for as little as 5% per month for amounts between ₦1,500 and ₦500,000.

Young professionals and students who need cash quickly for short-term wants love this app the most because the terms of repayment are open, and users can pick terms from one month to six months that work best for them.

10. Kwikmoney

Kwikmoney used to be called Kwikcash. It has changed its name but still offers fast loans without paperwork or visits. With this loan app, you can borrow up to ₦200,000, and the interest rate is usually between 5% and 15% per month.

The service is known for being easy to use and for getting money to people quickly, usually within minutes of acceptance. One thing that makes Kwikmoney stand out is that it works with cell network operators, which means that many people in Nigeria can use it.

Conclusion

Loan apps in Nigeria offer a fast and easy way for people to get money when they need it. These apps, like Okash, Alat by Wema, and Carbon, provide loans quickly without needing a traditional credit check, making them very handy for emergencies or urgent financial needs.

They allow different loan amounts and repayment times but usually charge higher interest rates because they don’t check credit scores.

But if you’re looking for loan apps with low interest rates then check out my guide.

While these apps are super convenient, users need to understand all the terms before taking a loan to avoid any trouble with debt later on.