Quickteller is a financial service application that enables you to make online transactions like sending and receiving money, airtime, paying bills etc. The digital payments company, Interswitch developed and maintain this application.

Interswitch is a digital payments and commerce company. They facilitate electronic payments and value exchange between individuals and organizations across Africa.

The company began operations in 2002 as an e-payment processing company and has since gone on to become a pioneer of innovative digital products and services, improving the ways we make payments online. The company also owns Verve, which is the first payment card to be accepted nationwide. Verve is also in 21 African countries and 185 countries all over the world.

Apart from being one of the most used e-payment platforms in Nigeria, Quickteller also offers fast loans.

So If you are in need of a quick short-term loan, Quickteller has got your back.

It’s safe, reliable and most importantly, hassle-free. You can get your loans in minutes. To access their credit, you will have to visit their platform and navigate to Quickteller loans. One more exciting thing about the loan product is that you neither need collateral nor a guarantor to borrow money. It’s straightforward to get and requires no paperwork from you.

This loan facility offers up to N50,000 depending on thecustomer’s financial history.

How To Successfully Apply For A Quickteller Loan

Quickteller is a great option to explore for a loan in Nigeria. Before you can apply for a Quickteller loan, you will have to register on their website. You sign up by filling in your details which would include your name, email, password, and mobile number. After filling in your information, you will get an OTP (One-time pin) on your mobile device. This One-Time Pin will is what you need to activate your account on the space provided on the Quickteller site.

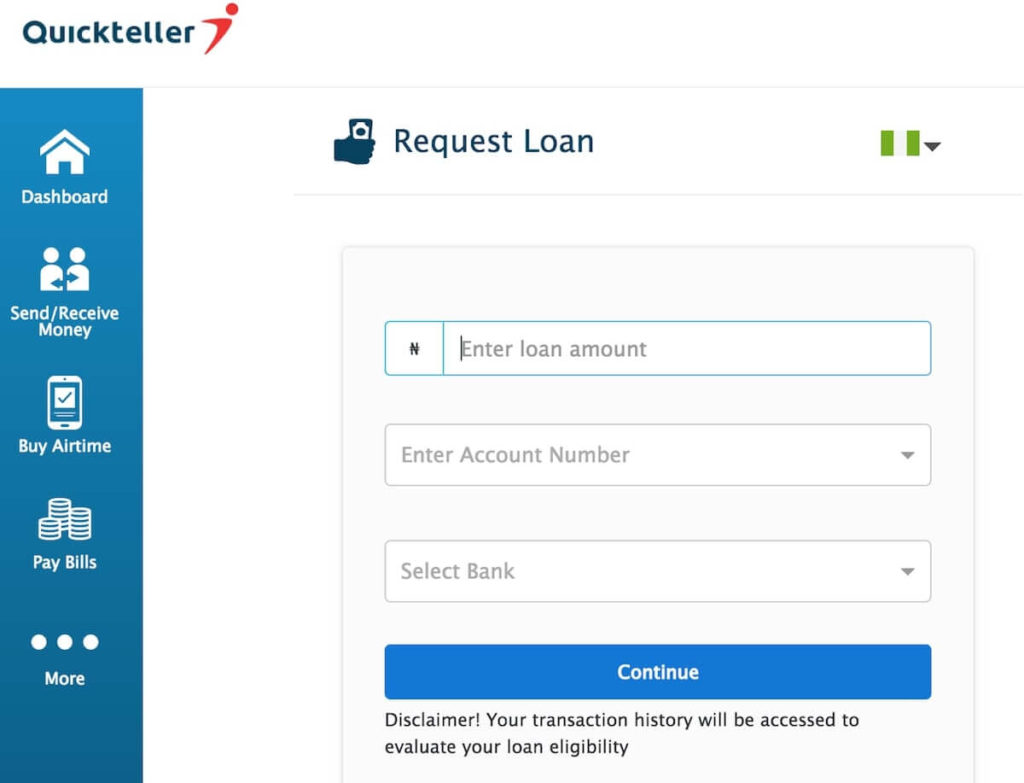

The next step to take is to sign in to your Quickteller account, add your bank details, and then make a request for a loan.

After registering you can now apply for a loan from your mobile device. Dial the USSD code *3226# and follow the prompts to apply. You can also request a loan via the Quickteller mobile app. Yes, it is available for both Android and IOS users so nobody will miss out. You can check out other USSD code for loans in Nigeria.

As soon as you meet the loan requirements, your request will get approved, and your account receives the money within a matter of minutes.

Quickteller Loan Repayment

Paying back the loan is as easy as getting it. You can conveniently repay your loans through various channels. Payments occur via ATMs, the Quickteller app or at the bank.

Quickteller offers between 3%-15% interest rates over a repayment period of between 10 days to 3 months. The interest rate of the loan depends on the lender’s evaluation of the applicant’s financial record.

However, it is essential not to take your loan repayment plan for granted. If you fail to pay back the loan as of when due, Quickteller will blacklist you. They will also report you to several institutions, making it hard for you to get future investments.

Conclusion

The Quickteller loan is an efficient solution for individuals who need quick cash to sort out emergencies and unexpected payments. Loans attract little or no hassle, and this guarantees that the average man has access to the loan package.

Banks onboard with Interswitch’s lending services include UBA, First Bank, Fidelity, Ecobank, and many others.

Check out the Related Posts below:

- How To Request For A Fint loan: Product Review

- Mint Loan App - How to get a loan from Mint Loan Nigeria

- Kada Loan - How to apply for a loan from Kada bank

- Naira Cash Loan - How to apply for a loan on Naira Cash

- NG Cares Loan - How to apply for a business loan in 3 steps

- NCash Loan - How to borrow a loan from NCash