NIRSAL (Nigeria Incentive-Based Risk Sharing System for Agricultural Lending) is a lending platform for farmers and people who work with food in Nigeria. Its main job is to help them get the money they need to grow more food and take care of their farms.

Most banks are afraid they won’t get their money back, so, getting money from them will be hard. That’s where NIRSAL steps in. It promises these banks to help if things don’t go as planned, making the banks more willing to lend money.

So, in short, NIRSAL’s purpose is to make it easier for people who grow our food to get the support they need. This way, they can grow more food, make their farms better, and everyone has enough to eat.

In this article, we will explore the types of NIRSAL loans, eligibility, how to apply for a NIRSAL loan & how to check your NIRSAL loan status.

Types of NIRSAL Loan

Here are the types of NIRSAL loans:

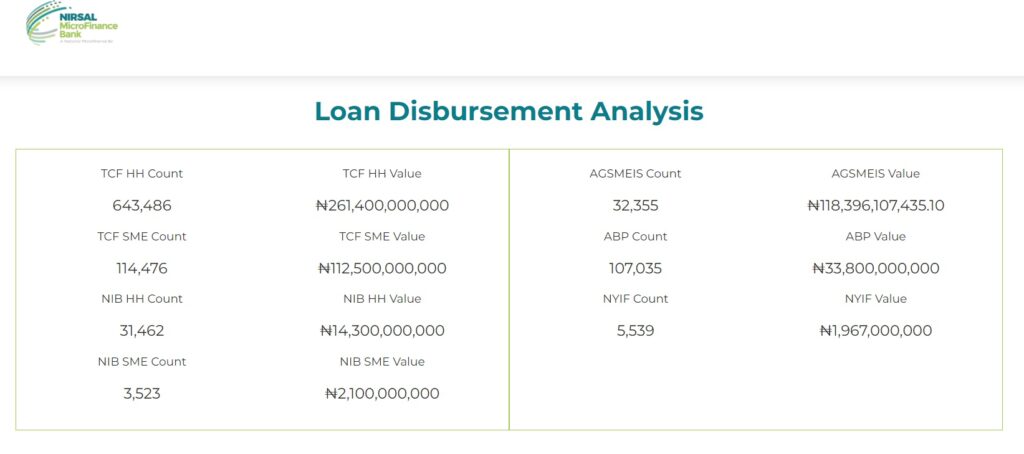

1. Anchor Borrowers’ Programme (ABP)

The ABP is an initiative by the Central Bank of Nigeria. It aims to create a mutual relationship between smallholder farmers and large agro-processors.

The goal is to increase farm output and productivity. Farmers will receive the needed inputs and resources. In return, these farmers supply raw materials to the processors.

This ensures a stable input supply and helps national food security. This program is key because it reduces imports of things we can make here.

2. Agric, Small Medium Enterprise Scheme (AGSMEIS)

This scheme supports the growth of small and medium enterprises (SMEs). It focuses on agriculture and other key sectors.

These include creative industries (arts, fashion), manufacturing, and ICT. AGSMEIS provides loans of up to N10 million at a 9% annual interest rate.

They do not require collateral and the program aims to foster innovation and boost the production of SMEs.

3. COVID-19 Targeted Credit Facility (TCF) Loan

The COVID-19 TCF Loan was introduced in response to the coronavirus pandemic. It provides relief to households and SMEs hurt by the economic downturn.

The facility offers accessible loans. They help beneficiaries manage the financial challenges of the pandemic. The loans support economic activities. They help sustain livelihoods during and after the crisis.

4. Nigerian Youth Investment Fund (NYIF) Loan

The NYIF is a groundbreaking initiative. It aims to harness the entrepreneurial potential of Nigerian youth. The fund seeks to back innovative ideas, projects, and enterprises.

The NYIF is committed to creating a minimum of 500,000 jobs. It offers loans at a 5% annual interest rate. The loans aim to encourage youth entrepreneurship.

They see it as a way to drive job creation, economic growth, and social innovation.

5. Non-Interest TCF Credit for SMEs and Households

This loan has no interest. They are a part of NIRSAL’s response to the needs of SMEs and households. They need financial support but without the burden of traditional interest rates.

These loans are tailored to help build or expand businesses and maintain lifestyles. They are great for those who prefer or need non-interest financial products.

6. AGSMEIS Non-Interest Loan

This is a variant of the AGSMEIS loan. It extends the scheme’s benefits to businesses and entrepreneurs. They seek financing without interest and support business growth.

Additionally, they help businesses in farming, the arts, and other sectors. This promotes economic variety and sustainable development.

Eligibility for NIRSAL Loans

To qualify for a NIRSAL loan, you must fulfil the following requirements:

- Applicants must be Nigerian citizens or operate a registered business within Nigeria.

- Applicants need to be engaged in the agricultural sector or related value-chain activities.

- You need a business plan. It should outline the reason for the funding, the expected outcomes, and the repayment plan.

- Some loans may need collateral. Or, applicants might join a group collateral arrangement.

- You often need a satisfactory credit score or a good credit history. They show you can repay the loan.

- This includes financial statements. Also, you need proof of business registration with the Corporate Affairs Commission (CAC). You also need proof of business ownership and address.

How to Apply for a NIRSAL Loan

You apply for NIRSAL funding through a structured process. Here’s a step-by-step guide on how to apply for a NIRSAL loan:

Step 1: Determine loan or support type

First, find the NIRSAL loan or support program that suits your needs best. Assess the project or business. Check if it meets the eligibility criteria of the NIRSAL program you picked.

Step 2: Gather the required documentation

Prepare all necessary documentation that will support your application. This includes:

- A completed application form from the NIRSAL website or a bank.

- A detailed business plan or proposal.

- A feasibility study or market analysis to prove the viability of your project.

- Financial statements show your financial history. They include balance sheets, income statements, and cash flow statements. They also include projections.

- Collateral documentation, if applicable, to secure the loan.

Step 3: Submit the application

Once all your documents are ready, submit your application through one of the following channels:

- An authorized financial institution or bank that partners with NIRSAL for the disbursement of funds.

- If you applied through the NIRSAL website. You can use it to submit your application online.

Step 4: Application review

After you submit, the financial institution or NIRSAL will review your application. They will asses your eligibility, the project’s viability, and your ability to repay the loan.

The thoroughness of your submitted documentation plays a crucial role in this step.

Step 5: Funding approval and disbursement

If your application is successful, you will be notified of your loan approval. You will then receive the funding under the conditions outlined in the loan agreement.

You must carefully review the loan’s terms. They include interest rates, repayment schedules, and other obligations.

Note: After receiving the funding, you must follow the repayment plan in the loan agreement. Paying on time is crucial. It keeps a good credit history and future financial eligibility.

NIRSAL Loan Interest Rates and Repayment Terms

The NIRSAL interest rate initially was set at 5% per annum until February 28, 2021. After the moratorium, the interest rate rose to 9% per year.

This started on March 1, 2021. For working capital loans, the maximum period is one year without an option for rollover. Term loans are available for a maximum of three years and include at least a one-year moratorium.

How to Check NIRSAL Loan With BVN

To check the approval status of your NIRSAL loan with your BVN, you can follow these steps:

- Go to the official NMFB loan portal.

- Look for the option that says “Check Loan Status” on the menu bar at the top of the page.

- From the drop-down menu, select the loan program you applied for.

- Input your Bank Verification Number (BVN) in the space provided.

- Click on “Submit” to view the status of your loan application.

How to Get a Reference Number for a NIRSAL Loan

To get a reference number for a NIRSAL loan, you typically receive it when you apply for the loan.

If you’ve applied and haven’t noted your reference number or need help, the best approach is to contact NIRSAL Microfinance Bank. They can give exact help on getting your reference number.

How to Check NIRSAL AGSMEIS Loan Approval

To check the approval status of your NIRSAL AGSMEIS loan, follow these steps:

- Visit the NIRSAL Microfinance Bank (NMFB) official portal.

- Look for the “Loan Application” or “Check Loan Status” option.

- Enter your BVN (Bank Verification Number) in the required field.

- Follow any additional instructions to complete the verification process.

How to Check Your NIRSAL Loan Status

To check your NIRSAL loan status, visit the NIRSAL Microfinance Bank (NMFB) portal or website. Look for a section such as “Loan Application” or “Check Loan Status.”

You will need to enter your Bank Verification Number (BVN) in the specified field. Follow any additional instructions provided to complete the verification process.

Pros & Cons of NIRSAL Loan

Pros

- They have a wide range of loan offerings

- Their rates are competitive

Cons

- Lots of paperwork for a large amount of loans

- You need a guarantor to access some loans

- There is compulsory training for recipients

NIRSAL Loan Frequently Asked Questions

Is Nirsal a loan or grant?

NIRSAL is not a grant. It provides loans for agriculture and related sectors in Nigeria. The aim is to boost growth and sustainability.

How long is the Nirsal loan for?

NIRSAL loan durations can vary. Terms are usually from six months to one year.

Is Nirsal Microfinance Bank giving out grants?

NIRSAL Microfinance Bank focuses on providing loans rather than grants. It aims to offer money to eligible people and businesses in farming. This support aims to foster growth and development.

Are there any alternative lenders or loan options available for those who don’t qualify for NIRSAL loans?

Although this blog post focuses solely on NIRSAL loan options, there are other alternative lenders within the agricultural space that can provide loans for you. One of these agricultural loan options is the Bank of Agriculture loan.

Conclusion

NIRSAL loans give hope to people in Nigeria’s farming industry. These loans provide the money needed to grow their dreams.

NIRSAL offers different loan choices, and fair interest rates to help people and businesses overcome money challenges and achieve their goals.

Remember, thorough research and understanding of specific eligibility requirements are crucial before applying.