Struggling to save some cash?

Or are you just always wanting to take out some money and spoil yourself silly? LOL, I get it the temptation is hard to resist.

Those temptations may arise but Opay’s “lock money” tool is here to be your saving superhero!

This handy feature not only lets you send and pay with ease but also helps you tuck some money away from those impulsive spending sprees.

Ready to conquer your savings goals?

Let’s dive into how you can lock money on Opay!

What Does it Mean to Lock Money on Opay?

Locking money on Opay is a function on the Opay mobile payment platform that lets users save money by temporarily limiting their access to their funds.

This tool, which is usually part of a larger digital wallet service, helps users keep track of their spending and save money for specific goals.

Users can make sure that their money can’t be used by anyone else until certain conditions are met, like a certain amount of time.

This is called “locking” the money. This helps users develop good saving habits and money management skills by keeping their money safe from rash withdrawals and spending.

Still, on good financial habits like saving, you should really check out my guide on how to navigate your finances in this tough economy.

How to Lock Money on Opay

To lock money on Opay, follow these steps:

- Open the Opay App.

- Select the ‘Finance’ option.

- Then select ‘Fixed’.

- Click on ‘Create a plan’.

- Input details about your savings plan

- Decide if you want to lock in the savings.

- Follow the prompts to finalize your savings plan, which will include selecting a payback date and confirming the payment method (using your Opay balance, Owealth, an ATM card, or bank deposit).

Opay Fixed Saving Modes

Opay offers two primary fixed saving modes: locked and unlocked.

In the locked mode, users commit their funds for a specified period, during which the money cannot be withdrawn regardless of the circumstances.

This mode typically offers higher interest rates as a reward for the lack of liquidity.

The unlocked mode, while still a form of fixed savings, allows for more flexibility, permitting withdrawals before the maturity date but usually at the cost of earning less interest.

This distinction allows users to choose between maximizing their interest earnings or retaining some access to their funds based on their financial needs and goals.

If you would, however, like to know how to borrow money from Opay (Okash loan), check out my guide!

Looking to grow your money even faster?

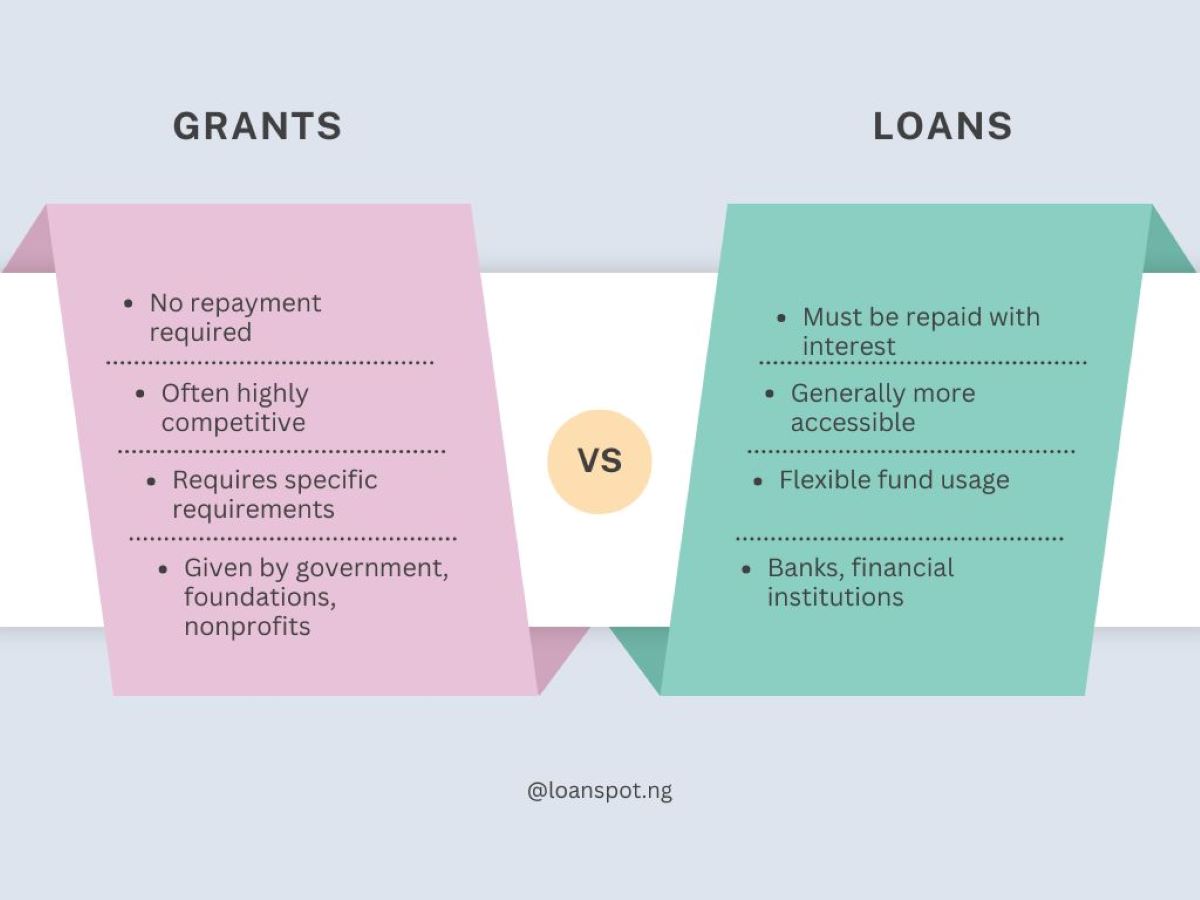

While Opay offers its own savings options, it’s important to consider the broader financial landscape.

Platforms like Loanspot facilitate connections between borrowers and lenders, potentially offering competitive interest rates and terms for borrowers seeking to achieve their financial goals.

You can get started with Loanspot right now. It’s easy peasy.

Disclaimer: Loanspot is not a Lender and does not offer loans to customers. Loanspot offers Lending Technology Infrastructure to Lenders empowering Lenders to offer loans to their customers Effectively, Securely, and at Scale.

Additional Considerations for Locking Money on Opay

- Before locking money, check the interest rates offered for different durations. Longer periods generally offer higher rates.

- Consider the possibility of needing funds in an emergency. Locked plans generally do not allow early withdrawal without forfeiting interest.

- There may be minimum deposit requirements for starting a fixed savings plan, so ensure you meet these to participate.

- Be aware of any taxes applicable to earned interest as per local regulations, which might reduce the net gains from your savings.

- Ensure your Opay account is fully verified to avoid restrictions on depositing or withdrawing large amounts.

- Align your decision to lock funds with your financial goals. Choose durations and amounts that help you meet specific targets without compromising your liquidity needs.

Conclusion

Opay’s set saving modes give you an adaptable way to handle your money; you can lock your money up to make higher interest rates or choose an easier plan with smaller returns.

When thinking about putting your money in Opay, it’s important to think about things like interest rates, your general financial goals, the minimum investment requirements, and your current and future financial needs.

You can use Opay to improve your financial stability and growth by knowing these factors and picking the right saving mode.

This will make sure that your savings work harder for you while still meeting your cash needs and financial goals.

FAQs

How do I hide my money on Opay?

To hide your money on Opay, log into your account, navigate to the balance display, and use the option to conceal your balance.

This feature helps maintain privacy and security by preventing others from seeing your available funds.

How can I save money in my Opay account?

You can save money in your Opay account by using the app’s savings features such as ‘Fixed Savings’ or ‘Owealth’.

Choose a plan that suits your financial goals, decide on an amount, and set the duration to start earning interest on your savings.

How do I put security on my Opay app?

To enhance security on your OPay app, activate additional security settings such as a PIN, password, or biometric features like fingerprint or facial recognition.

These measures ensure that only you can access and authorize transactions within your account.