The current inflation in the country also means increased expenses, hence, our curation of the top 10 best loan apps in Nigeria.

Don’t let financial worries dampen your spirit. Thanks to convenient loan apps, getting quick, legal, and secure financial assistance is sure with this list of trusted loan apps.

Ditch the stress and jump straight to convenience with these top-rated loan apps.

Let’s dive in!

<<Recommended – Top Best Loan Apps in Nigeria With Low-Interest

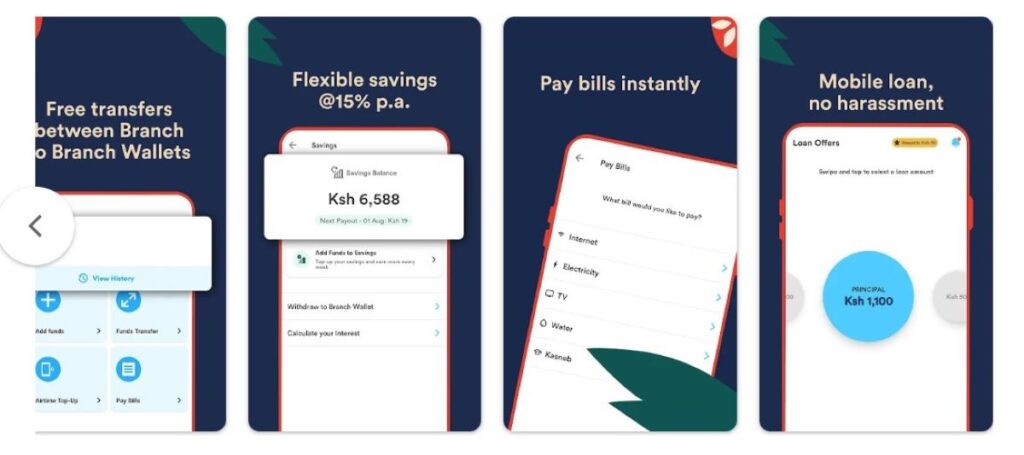

1. Branch Loan App

- Downloads: 10M+

- Rating: 4.5⭐

- Loan Range: ₦2,000 – ₦500,000

Branch, licensed by the Central Bank of Nigeria (CBN), is one of the best loan apps in Nigeria. This app is known for offering quick loans within minutes.

In addition, the Branch provides personal cash loans. The loans range from ₦2,000 to ₦500,000. The repayment period is 61-180 days.

For more information, you can visit the Branch website.

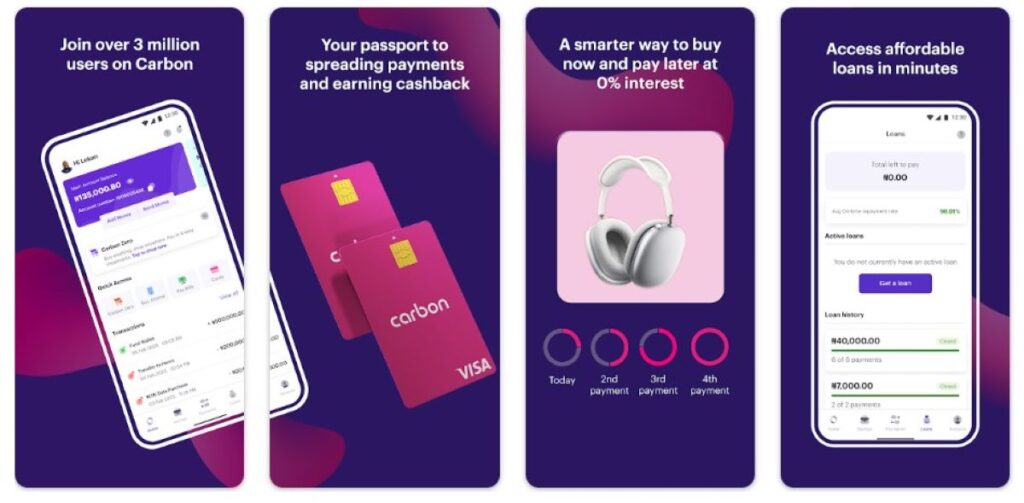

Carbon Loan App

- Downloads: 1M+

- Rating: 4.3⭐

- Loan Range: ₦1,500 to ₦1 million

Carbon is rated 4.3 out of 5 stars by over 1M users. This positions it as one of the best loan apps in Nigeria. Carbon offers loans without collateral, from ₦1,500 to ₦1 million, with a repayment period of up to 64 weeks.

For a 3-month loan of ₦50,000, you’ll pay 2% monthly interest, making the total repayment ₦53,000 after 90 days.

Additionally, we noticed a delay in confirming repayment while testing the Carbon app. You may notice that you keep getting notified to repay your loan even after you have done so.

For more information, you can visit the Carbon website.

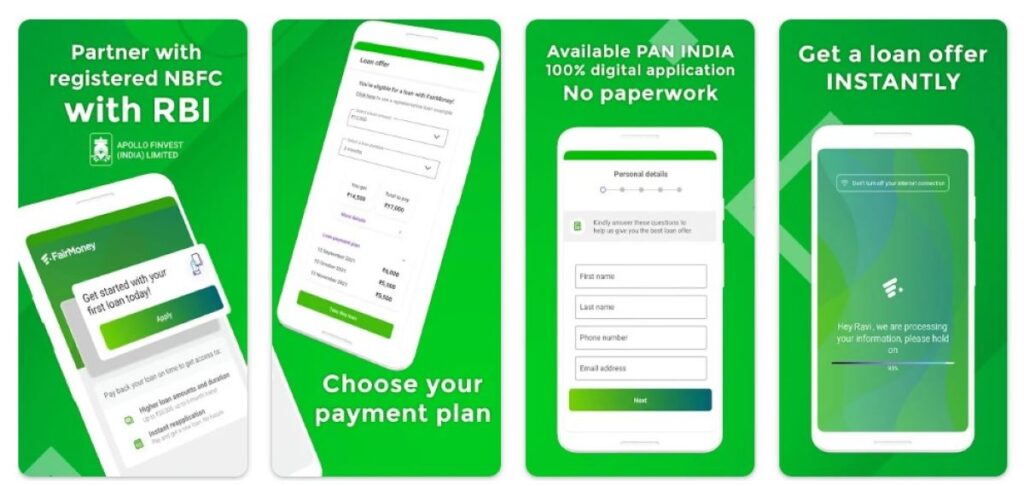

3. FairMoney Loan App

- Downloads:10M+

- Rating:3.1⭐

- Loan Range:₦1,000,000 (Individuals), ₦5,000,000 (SMEs)

Fairmoney holds a strong position as a top mobile app for loans as it is licensed by the Central Bank of Nigeria (CBN). It has over ten million downloads and a 3.1-star rating on the Google Play store.

This loan app caters to both individual and business needs. It offers short-term loans up to ₦1,000,000 for individuals and up to ₦5,000,000 for SMEs.

FairMoney simplifies the loan process. They provide quick loans in just 5 minutes without needing paperwork or collateral.

For more information, you can visit the Fairmoney website.

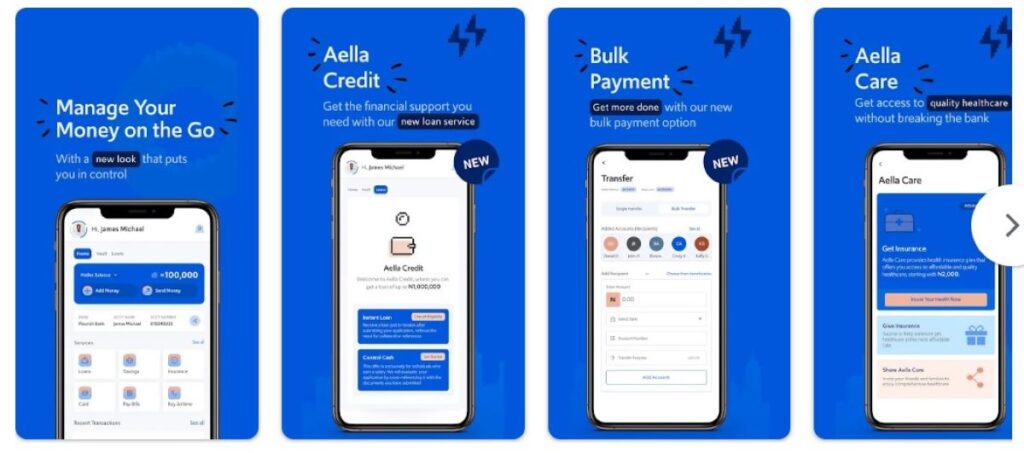

4. Aella Credit Loan App

- Downloads:1M+

- Rating:3.2⭐

- Loan Range:₦1,500 to ₦1,000,000

Aella Credit stands out in the money lending market as one of the best. It offers a comprehensive range of personal and business loans.

It offers an interest rate from 4% to 29% per month, catering to loan demands ranging from ₦1,500 to ₦1,000,000.

Aella Credit has over 1 million downloads and a 3.2-star rating. It’s recognized for its competitive interest rates and streamlined application process.

For more information, you can visit the Aella Credit website.

5. PalmPay

- Downloads:10M+

- Rating:4.5⭐

- Loan Range:₦10, 000 to ₦200, 000

The Palmpay loan app enables users to access loans up to N1 million at a 16% annual interest rate. PalmPay offers quick and easy money lending, making it one of the best loan apps in Nigeria.

You can also pay bills and invest in it. The app is available on the Google Play Store and Apple Store. It demands a phone number and BVN for loan applications.

It has a 4.5-star rating with over 10 million downloads.

For more information, you can visit the Plampay website.

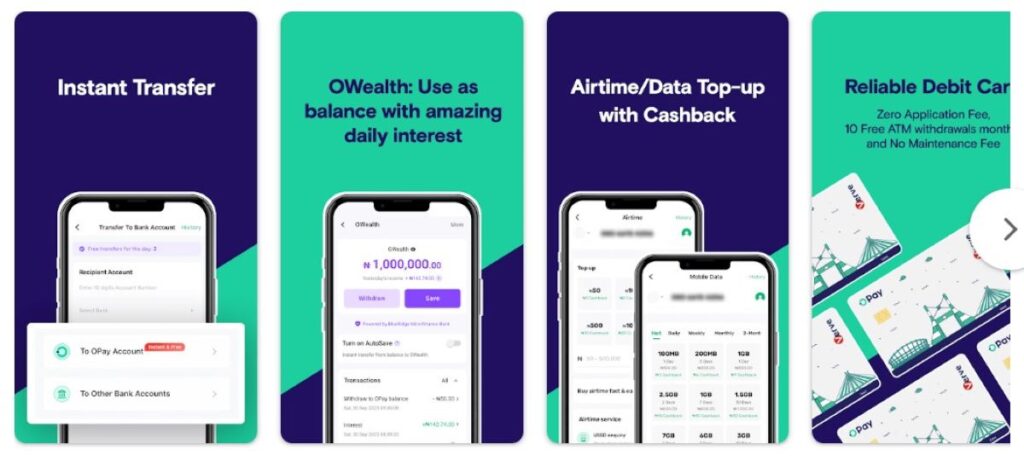

6. Opay (Okash Loan App)

- Downloads:5M+

- Rating:4.4⭐

- Loan Range:Loans up to ₦500,000

Okash, under the umbrella of Opay, is a significant player in the digital loan app market. It offers instant loans up to N500,000.

Its interest rates range from 10% to 30% per month. The app facilitates various services, including money transfers, bill payments, and online shopping.

On Google Play Store, it has a 4.4-star rating with over 5 million downloads.

For more information, you can visit the Okash website.

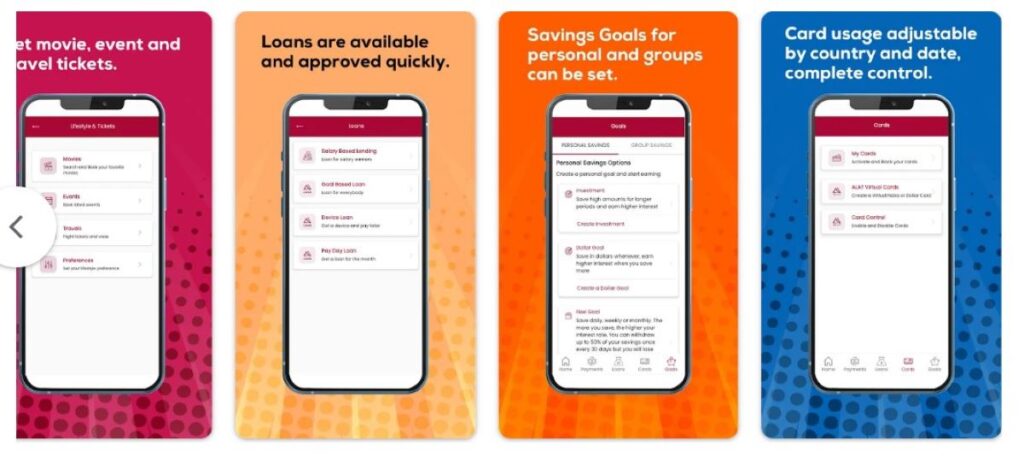

7. Alat by Wema bank

- Downloads:1M+

- Rating:3.9⭐

- Loan Range:Loans up to ₦5M

Alat, a product of Wema Bank and licensed by the Central Bank of Nigeria (CBN), blends digital banking with money lending services. The app offers a variety of loans, including salary-based and business loans.

Alat is available for download on the Google Play Store and App Store. This highlights its convenience for users seeking quick loans without traditional banking processes.

It has a 3.9-star rating and over 1 million app downloads.

For more information, you can visit the Alat by Wema website.

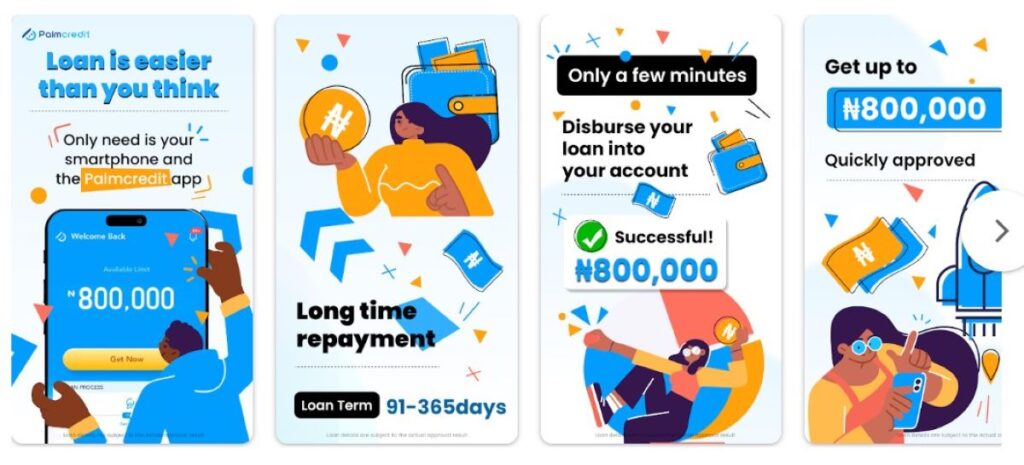

8. PalmCredit

- Downloads:10M+

- Rating:4.2⭐

- Loan Range:₦2,000 to ₦100,000

PalmCredit, with a 4.2 rating on the app store, offers small, short-term loans ranging from ₦2,000 to ₦100,000. These loans come with interest rates between 14% and 24%.

PalmCredit is licensed by the Central Bank of Nigeria (CBN) and is known for its straightforward and quick approval process. It is often completed within minutes. It is a favored option for those needing urgent, smaller loans.

9. CredPal

- Downloads:1K+

- Rating:3.9⭐

- Loan Range:₦5,000 to ₦500,000

CredPal, licensed by the Central Bank of Nigeria (CBN), is rated 3.9 out of 5 stars by over 1,000 users. You can get a collateral-free loan with CredPal of up to ₦500,000 for up to 180 days at 4-9% interest rates.

They also offer a Buy Now Pay Later service for items with a limit amount of ₦100,000, and a limit term of 2 months.

For more information, you can visit the CredPal website.

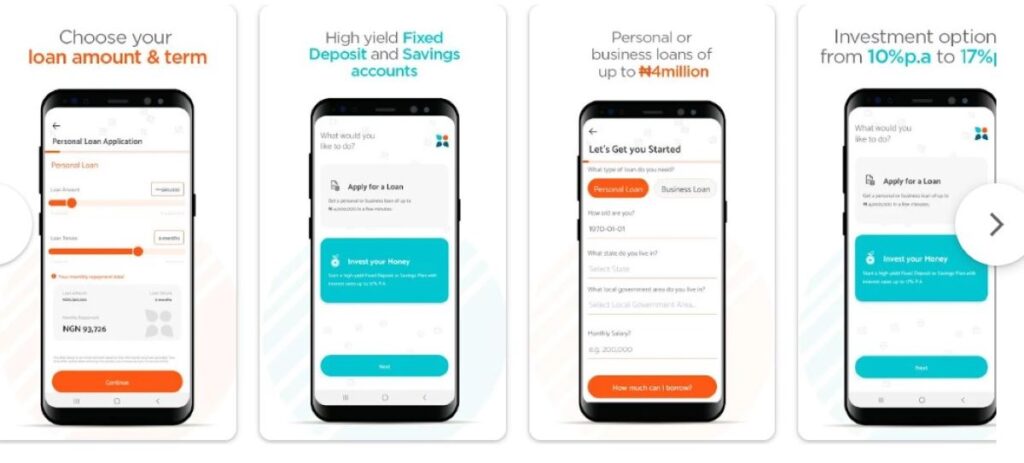

10. Renmoney

- Downloads:1K+

- Rating:3.9⭐

- Loan Range:₦6,000 to ₦6,000,000

Renmoney is rated 3.7 out of 5 stars by over 2,000 users which makes it one of the best loan apps in Nigeria. You can borrow up to ₦6,000,000 without collateral and repay in 3 – 24 months.

If you take a loan of ₦2,000,000 for a 12-month tenure, you’ll pay back ₦214,667 monthly. And by the 12th month, you’d have paid back ₦2,567,000.

For more information, you can visit the Renmoney website.

How To Choose The Right Loan App

1. Consider the interest rates and fees

Compare the interest rates and fees across different loan apps. Look for information on the annual percentage rate (APR). The APR includes both the interest rate and any additional fees. It gives a true sense of the loan’s cost.

2. Consider the repayment terms

Make sure you review the repayment schedule options before applying for any loan. Ensure the terms allow enough flexibility for your financial situation.

3. Check the user reviews

As I have done with the list of loan apps above, search for reviews on various platforms, such as app stores, social media, and financial forums. Pay attention to comments about the app’s reliability, customer service, and user experience. Look for patterns in feedback that could show potential issues or strengths.

4. Determine the loan amounts

Determine the exact amount you need before searching for apps. Then, check which apps offer loans that match your required amount. Don’t borrow more than you need. This helps in avoiding over-indebtedness.

5. Investigate the security and privacy

Investigate the app’s security measures and check its privacy policy to understand how your information will be used and protected.

Look for information on their website or in the app description about data encryption. Also, look for information on their website or in the app description about regulatory compliance.

6. Look out for their customer service behaviors and acts

Test the app’s customer service by contacting them with questions or concerns. Check if they are responsive, helpful, quick, and satisfactory in addressing your query.

<<Learn More – Top 10 Instant Loan Apps Without BVN in Nigeria

Loan Application Process

Applying for a loan via mobile apps in Nigeria has streamlined the traditional lending process. It has made it faster and more accessible.

Below are the steps for applying for any loan via mobile apps:

- Download and install the loan app (after researching and reviewing for the best)

- Register and set up your profile

- Complete the application form

- Check eligibility and submit the required documentation

- After submitting your application and documents, the app will process your request. This involves a credit check and verification of the information provided.

- If approved, the loan amount will be disbursed directly to your bank account or mobile money wallet, as per the app’s specific process.

Loan Apps Required Documentation

The documentation required can vary from one app to another, but generally includes:

- Valid identification. It can be a government-issued ID such as a National ID, Passport, or Driver’s License.

- Proof of income (optional)

- Bank account details

- Some apps may require a recent photo for identity verification purposes.

Loan App Approval Timeframes

One of the advantages of loan apps is their quick processing times. Approval timeframes can vary, but here’s what you can expect:

- Instant to a few hours

- Up to 24 hours

Tips for a Smooth Application Process

- Ensure all documents are clear and legible before uploading.

- Provide accurate and truthful information to avoid delays or denials.

- Have all required documents ready before starting the application to speed up the process.

- Read the terms and conditions carefully before accepting the loan.

Conclusion

To sum up, it’s easier to move around in the money world now because of new ideas. These best loan apps in Nigeria show how things are changing.

As we looked at these loan apps, it’s clear they make it easy for people to have more control over their money.