Menu

Loanspot provides a lending infrastructure that empowers lenders to offer loans effectively, securely, and at scale.

Loanspot provides you with a carefully curated supply of opt-in prequalified borrowers that are suited to your portfolio of borrowers.

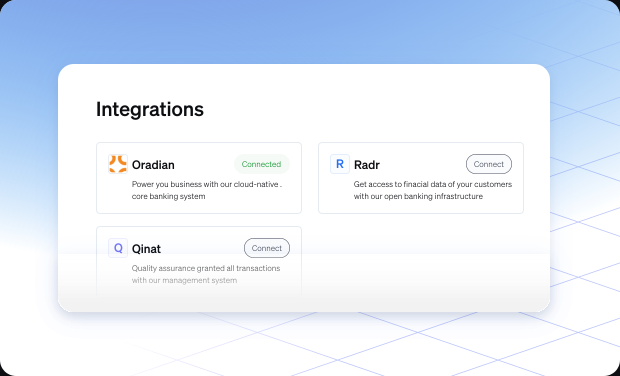

Securely disburse from a single platform with integrations to a wide variety of core banking applications. We provide you with exceptional predictive disbursement insights.

Our loan collection infrastructure automates your collection, increasing your collection rates while reducing your lending risks and improving your bottom line as a lender.

Adopt technologies that supercharges origination, disbursement, and collection with zero technology expertise required.

205a Corporation Drive, Ikoyi, Lagos, Nigeria.

+234 809 237 8856

info@loanspot.ng