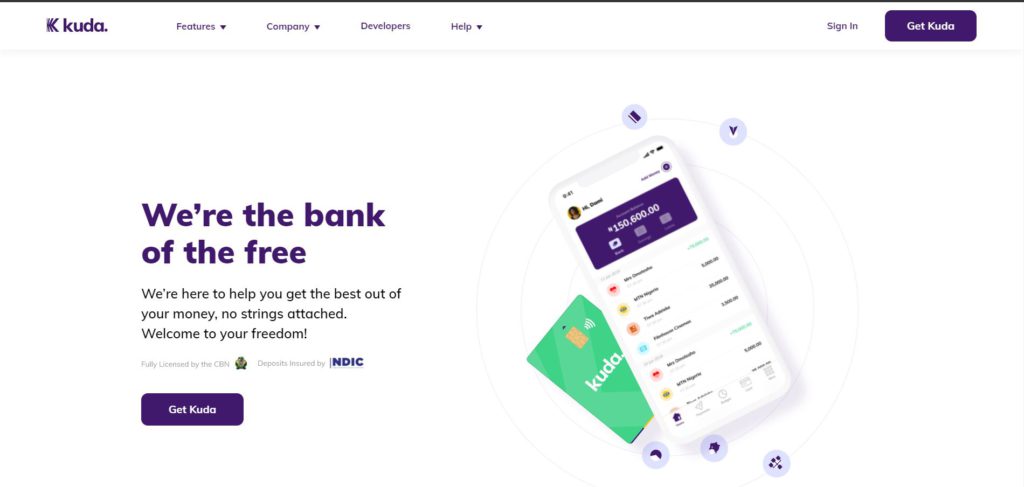

One of the latest trending bank apps in Nigeria today is the Kuda Bank app. Being an online-only bank has made it very unique and alluring to the majority of the youths in Nigeria.

The Kuda Bank is also packed with other exciting features that make it a good substitute to the conventional banking system in Nigeria. Without a doubt, it is one of the finest fintech companies in Nigeria. The online-only feature of the Kuda app makes it a bank that doesn’t require its users to visit any physical banks to make transactions or resolve any problem which may arise.

This is due to the stress people go through in physical banks. This stress could include long queues which waste time and will therefore hinder people from accomplishing their goals for going to the bank first off. In this article, we will be exploring every single thing about Kuda Bank, its unique features that makes it dependable, and an excellent substitute for conventional banking.

Who owns Kuda Bank?

Babs Ogundeyi is the CEO of Kuda Bank. He studied at Brunel University, London, and has engaged in working within the boundaries of finance for the majority of his career. His work focuses on the public and private sectors of Nigeria.

He was a previous employee of the PricewaterhouseCoopers advising banks, including acting as a senior special adviser pertaining to finance to the federal government of Nigeria.

Mr. Ogundeyi was part of the creation of the first classified car magazine known as the Motor Trader Nigeria which Financial Standard purchased later, a reputable Nigerian newspaper firm.

What is Kuda Bank App?

Kuda bank is primarily similar to a conventional bank but without any physical branch anywhere.

The monetary company is solely online and carries out online financial operations with a legitimate banking license from the CBN (Central Bank of Nigeria). The bank is particularly configured for smartphone users. This means that prospective customers without one will be unable to bank with them.

You can download the Kuda bank app on various smartphone platforms available as well as iPhone, Android, and Windows. It’s equally important to note that the app is stress-free and offers you banking service at your own convenience, which could be at home, church, school, or anywhere.

Furthermore, anyone with a smartphone can download the Kuda Bank app because of its user-friendly interface which enables easy navigation and performance on the app. Also, they’ve enhanced it for fast loading and will therefore allow quicker transactions.

Due to the power of digital and technology, using Kuda doesn’t attract any service fee. Its mission is to create the best bank for every African on the planet.

Get a loan up to N100,000 at the best affordable rates in Nigeria

Did you know that you can now you can compare interest rates from different lenders with our loan simulator and get the best deal? Making an informed loan decision requires comparing different loan offers before making a commitment. Through our simulator, you can see at a glance, loan offers coming from different lenders in less than 5 minutes, so you can make the right decision regarding your financing. Try it today

How does the Kuda App work?

The Kuda Bank app allows its users to monitor accounts with no charges like other conventional banks do, including free transferring of funds to other Nigerian banks, free debit cards, as well as providing loan services to customers.

These are mind-blowing offers to prospective customers because of the high fee charged by conventional banks for similar services like transferring funds to other banks, debit card issuance, and also ATM card maintenance. It is equally important to be aware that savings made with the app will be given out on loans to borrowers with specific interest attached.

Savings can also be invested into other businesses and interest from such businesses will belong to the bank.

This isn’t a cause for worry as this same method conventional banks earn with. The major difference is, kuda bank charges considerably lesser than other conventional banks. Proceedings from these investments made by Kuda Bank are sufficient to run the bank due to the fact that they don’t build physical branches.

Kuda Bank App Download for iOs and Android users

Due to the fact that the app is primarily optimized for smartphone users, it can only be accessed by users of Android and iOs devices.

You can search for and downloaded it from either the Apple app store or the Google Play Store.

How to get a loan from Kuda Bank

Thanks to Kuda Bank’s overdraft, it’s possible to take quick short-term loans online without doing any paperwork. Also, you can decide to pay back at any time with just 0.3% daily interest. Here’s how to apply for a Kuda Bank overdraft:

- Open the Kuda app and swipe to your borrowed account.

- Click on borrow.

- Click on Get your Overdraft.

- Touch next.

- Input the amount you want to borrow and then click on done.

- Verify your transaction PIN, face ID, or fingerprint.

- Click okay and you’re free to spend from your account.

Do you need a loan? Be sure to visit this loan platform that allows you to compare loans from different lenders in minutes. It offers the best and ensures that you get nothing less.

How to sign-up on the Kuda-app

Follow these steps to sign up on the Kuda app:

- Download and launch the app.

- Tap the sign-in option since you’re a new user.

- Fill in the required details. This will include your email address, password, and also your referral code.You can use a referral code to register if you someone referred you to the platform.

- On the second page, input your first and last name.

- Input your gender and date of birth as well as your phone number on the next page.

- Verify your phone number via the OTP which you will receive through the number provided. On the next page, give the details of your street name, city, and state.

- Finally, you will be required to take a selfie and that’s it. You become a bonafide Kuda Bank user.

Read also: Hope Bank – Digital banking made easy

Kuda Account

After signing up, you need to open an account. The Kuda app will provide an account number that you can use to execute transactions.

There are three types of unique accounts that you can use. They include:

- Lite

- Basic and

- Premium

You only need to provide your name and number to register on the Lite account, while you need a name, phone number as well as BVN to register on the Basic account.

The premium account is the highest tier. To register, you need a name, phone number, a valid ID, and BVN.

The premium account enables you to transfer funds as high as 250k max at once, plus maximum transfers per day extended to N1 million but stand at 500,000 on a POS.

Bonus and codes for Kuda Referral

To receive the referral bonus, you have to refer a new customer to open an account by downloading and signing up on the app. You receive N200 for every person that you successfully refer to create a new account on the Bank app.

Bottom line

Unquestionably, Kuda Bank app which is the foremost digital bank is here to stay. Not only is the bank convenient, but it is also user-friendly because it charges little to no bank or card maintenance fee, unlike other conventional banks. Although Kuda Bank still has a lot to do to assure users of its credibility, it is definitely a welcomed development as well as an inspiration for other financial institutions in Nigeria.