Carbon Loan is a product of One Finance and Investment Ltd. which started out as One credit in 2012.

The company at the time only provided loans to salary earners, using a complete paper-based approach to its operation which required substantiating documents.

In 2015, after even considerable growth in operation and turnover of its business, One credit evolved into OneFi. With the involvement of the Credit Bureau of Nigeria and the introduction of a unique Bank Verification Number (BVN), the company could extend its services to non-salary earners by leveraging its field agents.

In 2016, the business evolved into a fully digital platform, and its name then changed to Paylater. As a result of this upgrade, they were able to capture the minds of millions of Nigerians through data and smartphones.

They figured that by using data and leveraging technology, they could provide credit to more customers, and simplify their application process. This led to the complete annihilation of the paper-based application process.

What date was Carbon Launched?

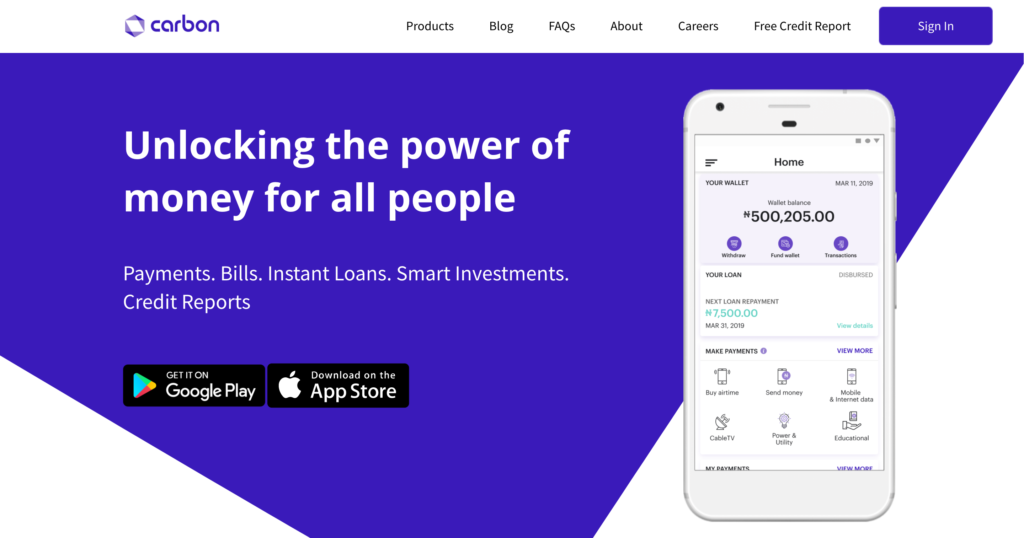

Carbon is a loan app in Nigeria that launched in May 2016. It was one of the best and first services of its kind—a fully digital lending platform that is available 24/7. You can get cash into a person’s account within minutes. Two years later, the Paylater mobile App has gotten over 1 million downloads.

To meet certain demands of the times as well as the complex nature of the customers’ needs, the Carbon loan app was introduced. It expanded from just loan disbursements into bill payments, investments, and financial management.

Carbon is a representation of a person’s everyday needs and how they evolve into their existence. It also represents their intent to be a one-stop source for accessing a loan in Nigeria.

The Carbon Paylater App

- Ratings – 4.4-star rating with over 71k reviews

- Downloads – Over 1m downloads since 2016

- Year of Release – 2016

The Carbon App is a one-stop destination for mobile financial transactions. You can get instant loans to meet urgent financial obligations, effect a money transfer to another account, investments at high-interest rates, recharge airtime and pay bills anytime. All these and more can be done on the App right from your mobile phone.

How To Use The Carbon Loan App

- Search for the app “Carbon” on Play Store or App Store to download

- Download the App

- Create your account in minutes

- Get instant access

There are four sections with distinct features you may find useful.

- Loan Section: This is the first section where you can request for a loan.

- Payment Section: In this section, you can carry out various payment activities. These include buying airtime, sending money to someone, subscribing to the internet and paying electricity bills.

- Financial Tools Section: This section offers investment opportunities such as opening a fixed deposit account. You also get a free credit report here.

- Transactions Sections: Here, you get an overview of all transactions you carried out on the App.

How To Get a Carbon Loan

Follow the steps below to obtain a Carbon loan

- Register to provide all the details. Name, phone number, email, etc

- Upload your photo before you can access loans. The picture can be taken directly from the App

- Click on the “Request a Loan” button

- Wait for your loan approval. This usually takes only a few minutes

- After loan approval, you accept the offer and provide your card details. Usually, the duration of the loan ranges from 30 days to 12 months.

What is Carbon Loan USSD Code?

The Carbon Paylater USSD code can be used on both MTN and 9mobile platforms by dialling *1303#. You can check out this post to see other USSD codes for loans in Nigeria. To make things easier, you can compare loan offers from different lenders through the loanspot africa platform. This enables you to select the best option that perfectly suits your needs in a matter of minutes.

How to Pay Back a Carbon Paylater Loan

Loan repayment on the Carbon Paylater app is straightforward, and there are different channels through which you can pay back your loan.

There is a direct debit channel. This channel enables the App (by your permission) to deduct the loan amount due directly from your account on the date stated by you. During the loan application, you would have filled out the details of your bank account as well as your preferred date of deduction.

You can also pay directly into their account either by transfer or over the counter. As soon as there’s confirmation of payment, your carbon account will be updated automatically.

What are the Advantages of Carbon Loan?

With Carbon, easy financial transactions are always just a click away.

- Their service is available 24/7 and you can initiate and effect a transaction anywhere on your mobile

- Minimum requirements of just an android phone, data connection and a valid means of identification

- Funds are available for everyone regardless of who you are

- Transparent services. No hidden charges

- There are several rewards for any positive actions like a referral, early repayments, etc.

Get a loan up to N100,000 at the best affordable rates in Nigeria

Now you can compare interest rates from different lenders with our loan simulator and get the best deal. Making an informed loan decision requires comparing different loan offers before making a commitment. Through our simulator, you can see at a glance, loan offers coming from different lenders in less than 5 minutes, so you can make the right decision regarding your financing. Try it today